Micro-credit culture has been an unparalleled achievement in the rural economic development of Bangladesh after liberation movement to stand back and contributing to our national economy. I don’t know how this micro-credit culture has built our long-standing mentality of living on compassion, so I think this development credit program has slowly started the process of building self-reliance and self-respect. First of all, one of the features of this development credit program is to give credit to the member by trusting them and to improve their quality of life by using this loan which is known to all.

Economic empowerment has a positive relationship with development. People will have significant change if he/she achieve economic solvency. Especially the rural people those who do not get available financial support for investment have the ability to uplift their socioeconomic condition after getting financial support. Contextualizing the scenario SARPV initiated their micro credit program at Coxes Bazar region officially in 2006, earlier this program was running as interest free revolving loan support. That time poor women and person with disability were prioritized for getting the loans that ultimately generated their employment. Since then this program is continuing as one of the major programs of SARPV that has opened a new window for these under privileged people to live a dignified life with availability of opportunities.

In 2012 SARPV inaugurated Interest free micro credit for PwD to enhance their capacity of money management and to promote entrepreneurship among them. Moreover this credit opportunity ensured the available money flow for their investment that uplifted the socioeconomic condition of PwDs

Objectives of the program

1. Reduce poverty

2. Enhance the capacities of people in the area of money management

3. Elevate socioeconomic condition of vulnerable groups especially women and PwD.

4. Develop entrepreneurship at community level.

Geographic Coverage of the Program: Chattogram, Cox’s Bazar & Bandarban Districts

Field officer conducting group meeting at field.

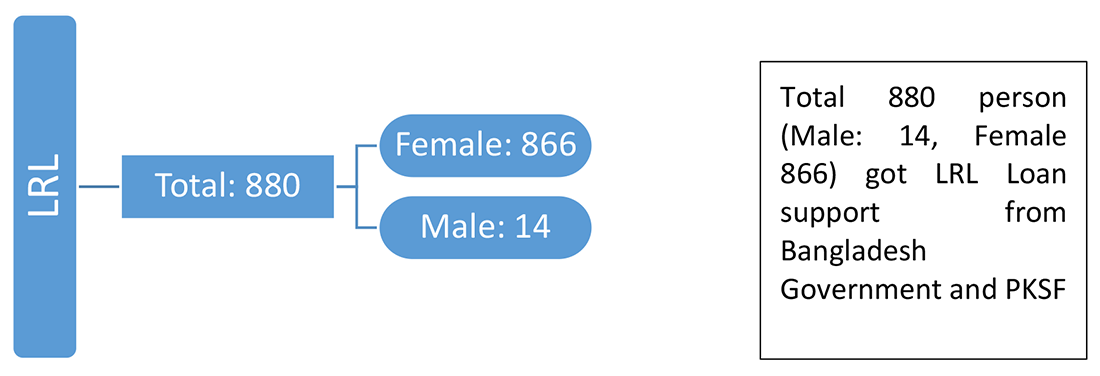

SARPV believes that every single person regardless sex, ethnicity, disability are potential resources for development. Contextualizing the economic condition and availability of resources specially for PwDs, this organization started this program in 2006 as a component of community-based rehabilitation for PwDs. Though the financial capacity indicates the social wellbeing for the vulnerable groups, SARPV continued this program since then. SARPV obtained the legal permission from Microcredit Regulatory Authority in 2011 and became the 275th partner organization of Palli Karma Sahayak Foundation (PKSF) in 2017.

2020-2021 was very challenging to operate this program because of COVID-19 pandemic. All the program staffs and its beneficiaries had to confront life threat throughout the year and had to survive during this adverse situation.

Targeted Population: People with Disability, Marginalized Men & Women, Covid-19 affected entrepreneur, entrepreneurs of natural disaster-prone/climatic vulnerable areas, ethnic groups.

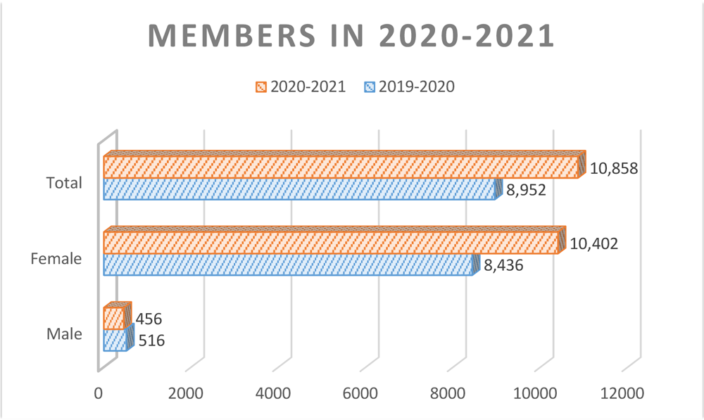

Beneficiary Coverage: 10858, (Female: 10402, Male: 456)

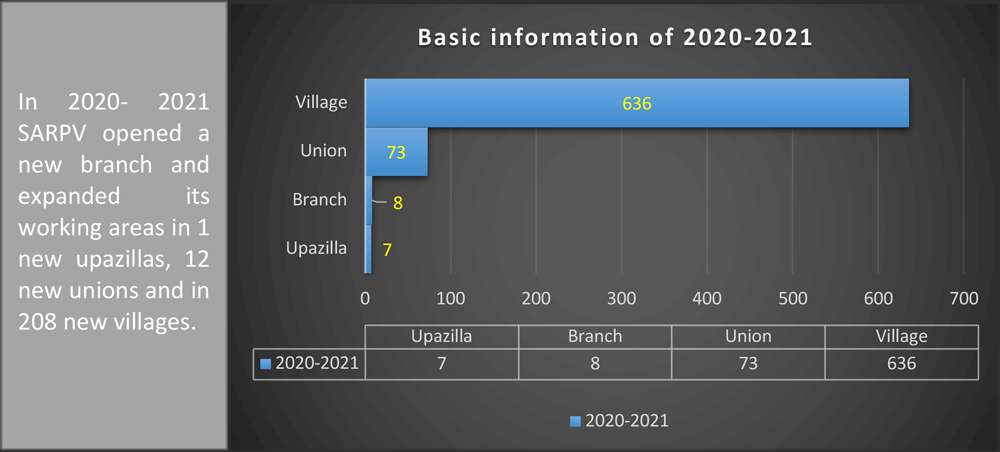

Currently this program is operating its activities in Chakaria, Pekua, Upazillas of Cox’s Bazar District, Lohagara, Satkania & Chandanaish upazillas of Chattogram district and Lama upazillas of Bandarban District from its 8 different Branches.

Program Details

Components of Micro finance Programs

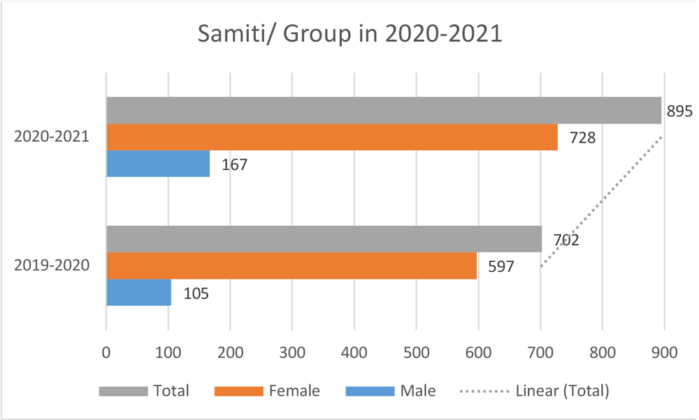

Due to the lockdown situation, it was very difficult time to operate the program, SARPV’s Staff gave their best for the organization. they increased 193 Samiti last fiscal year.

Total 1906 member were increased last year (1966 female members were added & 60 male members were excluded). Current total Members are 10858, (Female: 10402, Male: 456)

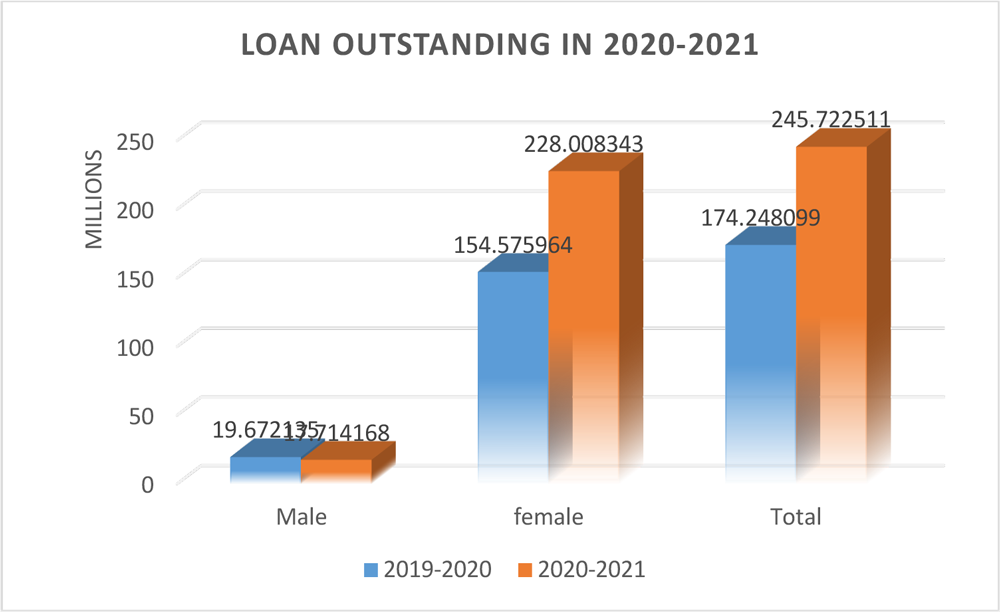

Comparing with last year, Total 1,666 Borrowers were increased among which 1707 were female and we canceled 41 male borrowers. At present total Borrowers are 7916 (Male: 327, Female: 758 BDT 71.474412 Million was increased last year and total outstanding is BDT 24,57,22,511

BDT 71.474412 Million was increased last year and total outstanding is BDT 24,57,22,511

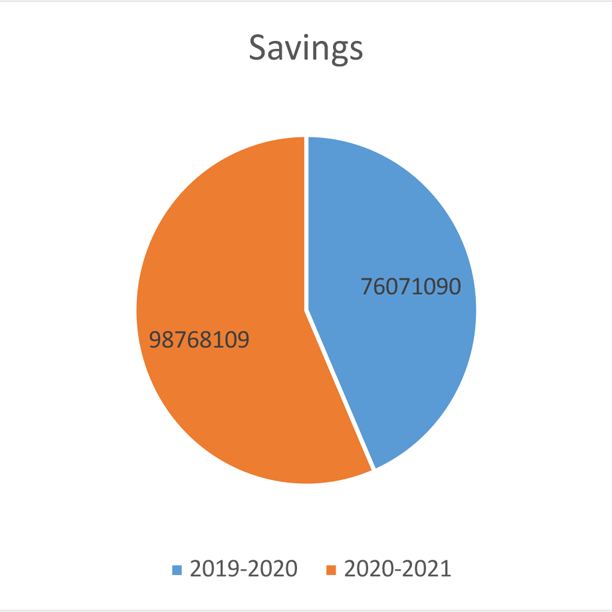

Last year BDT 22.697019 Million Savings was increased. Total Savings amount of 2020-2021 is BDT 9,87,68,109.

Last year BDT 22.697019 Million Savings was increased. Total Savings amount of 2020-2021 is BDT 9,87,68,109.

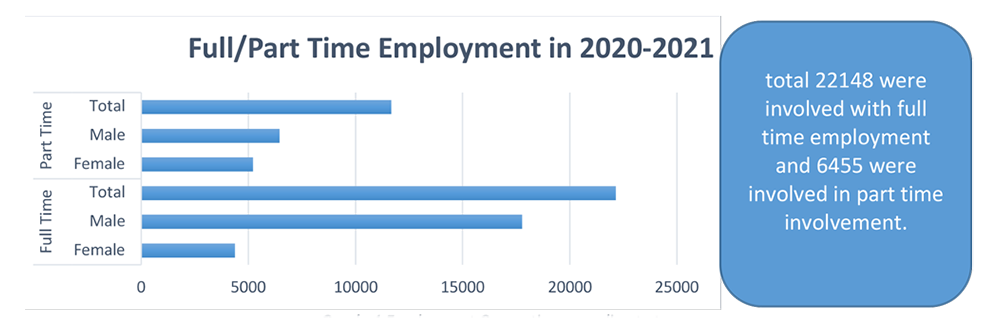

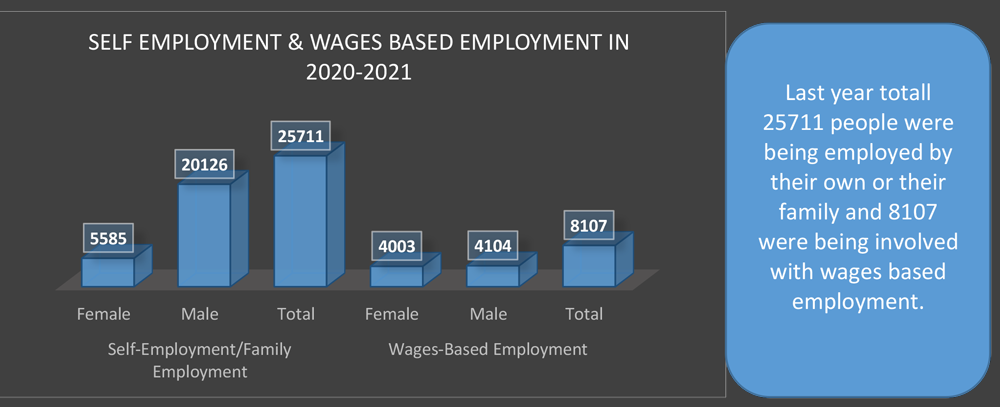

Employment Generation:

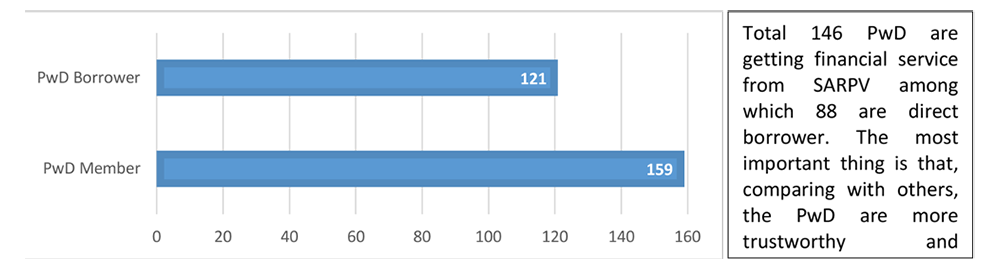

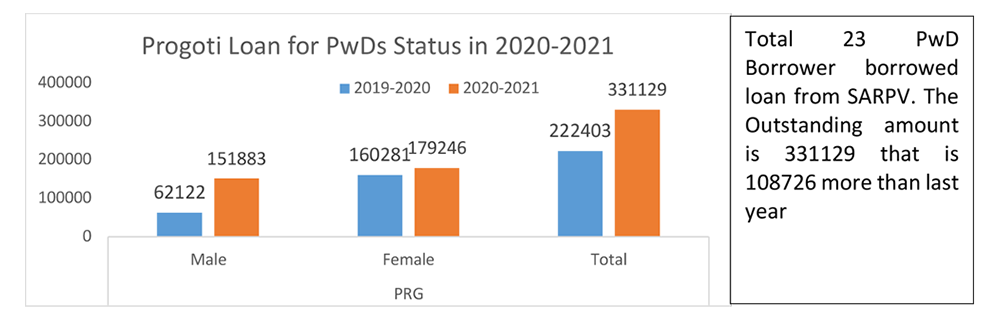

PwD Coverage through this Program

Impact of Covid-19 in last year

Due to Lockdown situation our organization could not operate properly and failed to achieve the target. This lockdown affects thrice in last fiscal year, firstly in July & August of 2020, secondly from March to May 2021 and lastly in June 2021. Due to the situation our organization earned BDT 4,931,237 less than we could able to earn.

Scholarship from PKSF: 14 Students got BDT 12000 each as scholarship from PKSF.

Students are receiving the Scholarship Cheque from the Mayor of Chakaria Municipality

Students are receiving the Scholarship Cheque from the Mayor of Chakaria Municipality

Learnings

- If small business person gets loan support during scarcity, they can avoid their losses.

- Few local persons mislead the general people on the government instruction that put in danger to operate the field level task according to Govt instruction.

Note: Success Story of Monwara Begum and Nargis Begum (HYPERLINK)